Session:

House Member

Committee Assignments

| Committee | Position | Minutes | Agendas |

|---|---|---|---|

| Commerce | Chairman | Click here | Click here |

| Appropriations | Member | Click here | Click here |

| Health & Human Services | Member | Click here | Click here |

| International Trade | Member | Click here | Click here |

| Committee | Position |

|---|---|

| House Appropriations Committee of Reference | Member |

| House Commerce Committee of Reference | Chairman |

| House Health & Human Services Committee of Reference | Member |

| Personal Information: | |

|

Home City: Chandler Member Since: 2015 |

|

|

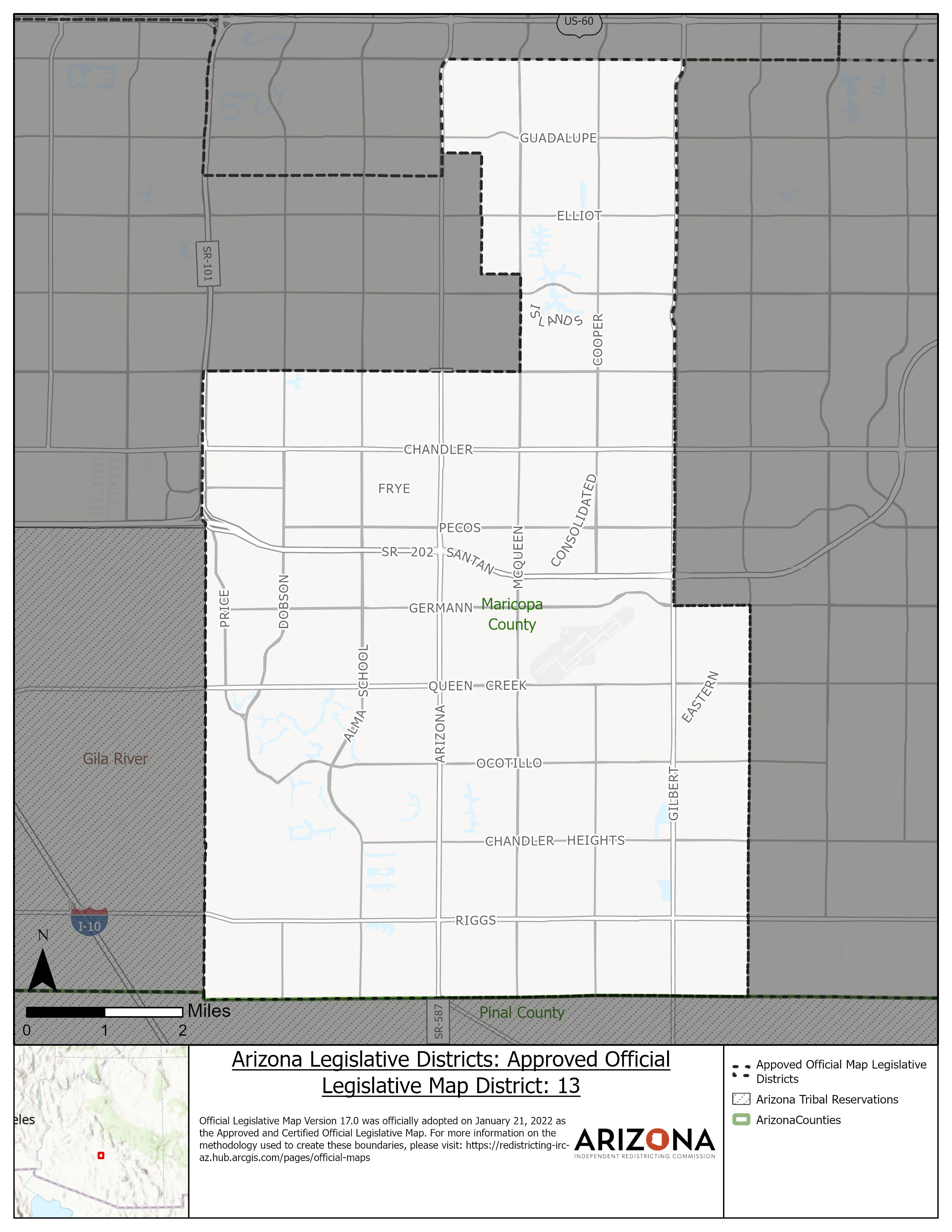

Representative Jeff Weninger is serving his first term for Legislative District 13 after previously serving in the House of Representatives for four terms representing Legislative District 17. His district serves Gilbert, Sun Lakes, and a large portion of Chandler, where Jeff resides with his wife, Janet, and raised their three children. Before serving as a State Representative, Jeff served on the Chandler City Council for eight years and held the position of Vice Mayor. He became known as the commonsense councilman and created a culture that ultimately changed the way Chandler employees approached spending tax dollars. Chandler's budget remained one of the strongest in the state during the economic downturn and without cutting needed services. Jeff served on and worked with several community and government boards including:

Representative Weninger is proud to serve the citizens of Arizona. He has made a commitment to be a leader for small businesses, education dollars in the classrooms, and to ensure the safety and protection of every citizen in the great state of Arizona. |

Sponsored Bills

P = Prime

C = Co-sponsor

C = Co-sponsor

| Bill Number | Sponsor Type | Short/NOW Title |

|---|---|---|

| HB2253 | P | testimony; disciplinary action; prohibition |

| HB2254 | P | special plate; small business advocate |

| HB2255 | P | teachers academy; community college students |

| HB2279 | C | commercial river outfitters; limited liability |

| HB2308 | P | dental insurers; dental practice; prohibition |

| HB2309 | P | earned wage access; providers; license |

| HB2310 | P | qualified marketplace contractors; employment |

| HB2316 | C | middle school students; CTE courses |

| HB2342 | C | homeowners' associations; shade structures |

| HB2373 | C | income tax; refunds; veterans' organizations |

| HB2666 | C | sexual extortion; classification |

| HB2671 | C | chronic felony offenders; juveniles |

| HB2676 | C | juvenile restoration; rights; firearms; civil |

| HB2678 | C | TPT; diapers; feminine hygiene; exemption |

| HB2824 | C | capital improvement; financing program |

| HB2836 | P | tax credit; fraud prevention organizations |

| HB2837 | P | notary public; examination; repeal |

| HB2838 | P | education workforce innovation; pilot program |

| HB2870 | P | residence of sex offenders; regulation |

| HB2871 | P | technical correction; limited partnership |

| HB2872 | P | technical correction; statute of limitations |

| HB2873 | P | competitive sealed bidding; questions; answers |

| HB2874 | P | campaign committees; termination statements; contributions |

| HB2875 | P | local regulation; prohibition; unmanned aircraft |

| HB2876 | P | public bodies; executive sessions; agenda |

| HB2877 | P | timeshare salespersons; licensure |

| HCM2009 | C | subsurface minerals; access; federal policy |

| HCR2043 | P | congressional term limits; convention |

| HCR2044 | C | preferential treatment; discrimination; prohibited acts |